These days, I’m looking at SEO research a little differently. Most of the data that’s been most valuable for developing SEO-friendly content isn’t from Google, Bing or even third-party SEO tools.

Platforms like TikTok, YouTube and Reddit act like search engines, and they’re rich with data about markets, audiences and what engages them.

In a world where creating strong SEO content means creating user-first content, this type of data is immensely valuable: It’s rapid consumer intelligence using what’s already available.

Here, I’ll explain how to use “non-traditional” data sources to gain powerful insights that can lead to a differentiated, effective SEO content strategy.

Breaking down the data silo

When we talk about SEO insights and research, it’s only natural to think about the SEO bread-and-butter metrics: keyword, SERP and domain data.

That’s just one slice of the pie. In our more market-intelligence-focused model, SEO-relevant data breaks out into three distinct categories.

- Search data.

- Social data.

- Forum data.

Each has its own unique value in terms of what it can help us understand about target markets and audiences.

Demand data

When someone conducts an online search, they’re taking action prompted by a need for products, services or information. Put another way: they’re exhibiting “active demand.”

By adopting this perspective, we can use search data to gauge demand for whole industries, specific verticals, unique topics, individual brands and beyond.

It’s bigger than Google because search activity happens on any public website where a user enters a query to find relevant content from a library of websites or creators.

Relevant data

- Competition research compares brand demand apples-to-apples while defining how much demand each captures within the landscape.

- Hashtag (#) volume measures content saturation across the content landscape (by topic or brand).

- Historic trends illustrate the trendlines of change for demand over time for any topic area.

- Keyword intent identifies where users are in their customer journey plus common language and behavior at different funnel stages.

- Keyword volume quantifies how often people are actively seeking products, information, or brands at a given time.

Demand data sources

- Google Ads.

- Google Search Console.

- Google Trends.

- YouTube API.

- Third-party tools like Ahrefs or Semrush.

Engagement data

Likes or follows are important. They tell us that the content or brand was able to cut through the noise and engage the user.

Through that lens, when we take a step back, data from social media platforms becomes a way to measure engagement at scale.

Analyzing this data identifies trends and tactics that cut through the noise, giving brands a better idea of where to “turn up the volume.”

Relevant data

- Audiences provide valuable demographic data based on interests and motivators.

- Followers illustrate how well brands are growing a loyal, organic following.

- Hashtag volume quantifies how much content is created around a topic or trend over time.

- Likes and views show how well content engages users and generates interest or inspiration.

Engagement data sources

- Facebook and Instagram.

- LinkedIn.

- Pinterest Trends and API.

- TikTok Trends and API.

- X (formerly Twitter).

Sentiment data

Forums, reviews and comments are vast libraries of unbiased qualitative feedback.

I like to call this category of information “sentiment data” because it paints a detailed picture of how people feel, how they communicate it and what they’re most passionate about.

Collecting sentiment data is an exercise in collecting the types of qualitative statements consumer insights studies take months to gather. Except, we can collect them in just days.

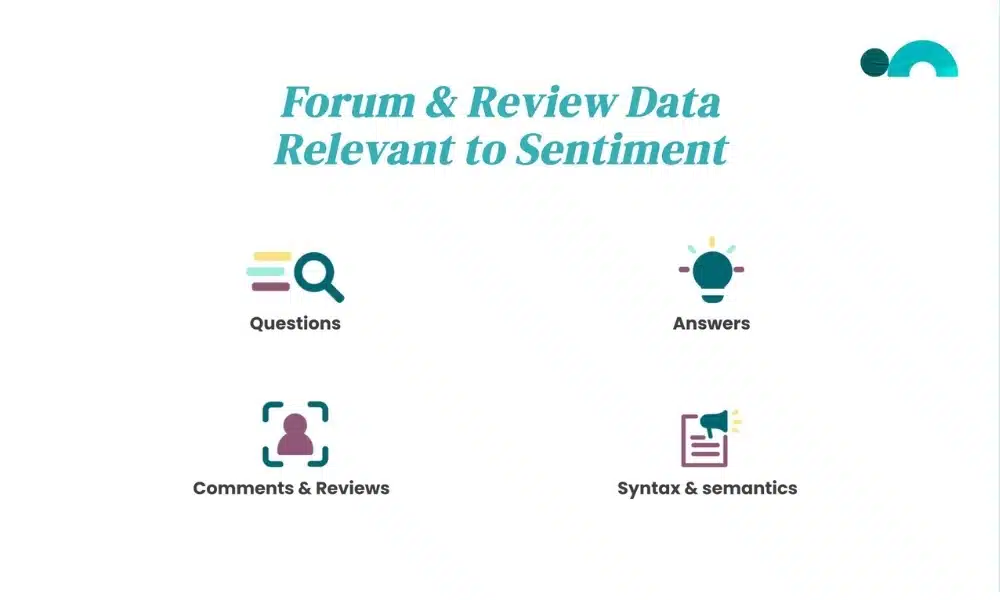

Relevant data

- Questions represent real problems that real people are trying to solve while telling us how prevalent these issues are.

- Answers show which types of information (and which authors!) answer those questions best.

- Comments and reviews provide real, uncensored consumer sentiment about products, trends and topics.

- Syntax and semantics tune into the language audiences use to solve problems and express opinions.

Sentiment data sources

- First-party data.

- Forum sites like Reddit.

- Marketplaces like Amazon.

- QandA sites like Quora.

- Review aggregators.

Get the newsletter search marketers rely on.

From everyday data to digital market intelligence

Digital market intelligence (DMI) involves the analysis of demand, engagement and sentiment data to uncover powerful insights about markets and audiences.

DMI collects and analyzes up to millions of digital data points – from public, ethically sourced data – to gain insights that would traditionally require qualitative surveying.

Often, it’s also more accurate because:

- The data is based on real behavior from real people, minus survey bias or influence.

- It only takes a few days to collect vast data sets, so you know they are timely and relevant.

- Instead of a small survey sample, DMI collects data from large swaths of the population.

Sourcing data for DMI

The methods we use to gather DMI data boil down to four primary tactics:

- APIs and platform-provided tools: Access APIs provided by platforms or reference platform-specific reporting where we can pull anonymized interest and behavior data at scale.

- Crawl: Use tools to crawl public web content at scale, find meaningful patterns and follow them to the insights.

- Third-party tools: Use third-party tools like Semrush, Apify or GummySearch, which aggregate and analyze robust data sets.

- First-party data: Weave in first-party data to connect the dots from the market to what the numbers actually mean for your business.

Leveraging digital market intelligence for SEO

Knowing the target audience and market is the crux of SEO. It’s how brands create the right content to get in front of the right people. Digital Market Intelligence illuminates who those people are, what they want and what catches their attention.

It adds a layer of context to traditional SEO research that can help differentiate and finetune content strategy.

Using demand data for SEO is pretty straightforward because, in large part, it’s what SEOs do day in and day out.

Let’s dig into the types of insights that engagement and sentiment data yield and how to get there.

We’ll focus on simple but powerful examples that use digital data (always ethically sourced and anonymized!) from common platforms.

Use Reddit to pinpoint the topics that matter today

Google’s success hinges on surfacing helpful results based on user search intent, which has been an area of struggle in recent years.

As more users abandon Google for other means of finding answers, especially user-generated content (UGC), Google is putting UGC results in the forefront – and Reddit is the clear winner.

One big piece of the puzzle is information gain, a framework Google uses to help users forage for information by prioritizing new conversations on SERPs.

Finding the conversations that matter early gives brands an edge in creating differentiated content that offers something new.

Reddit is where those conversations happen, and a tool like GummySearch can help pinpoint them before competitors have their say.

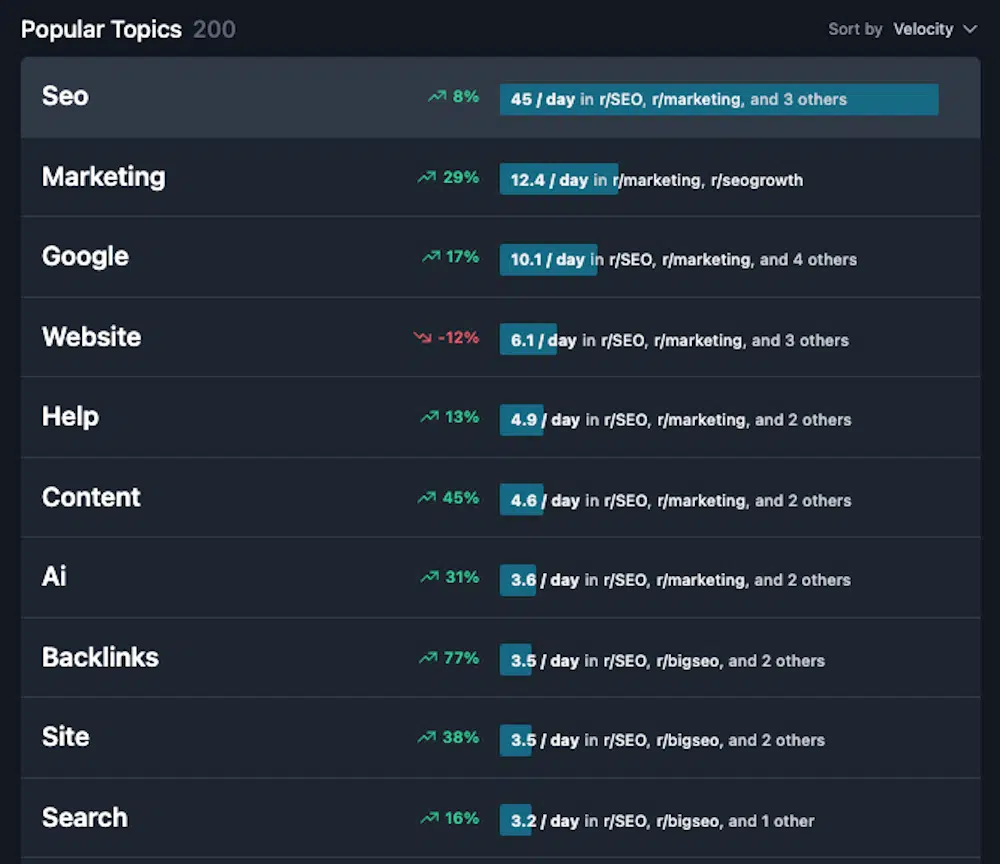

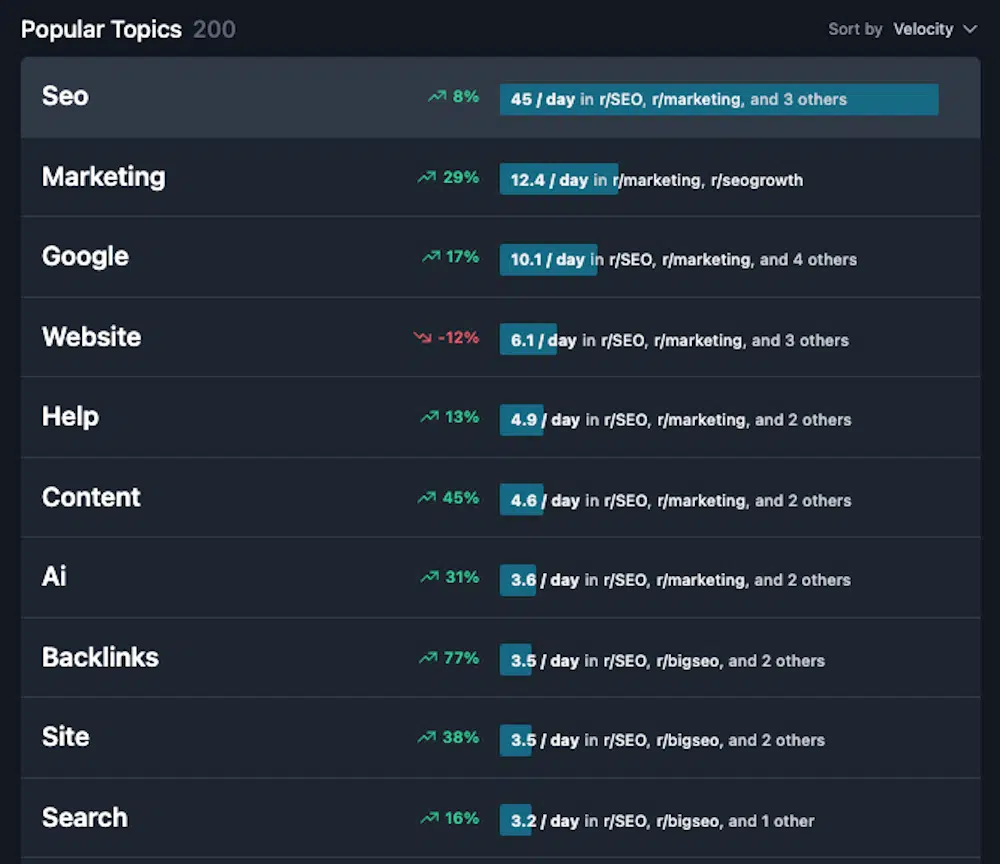

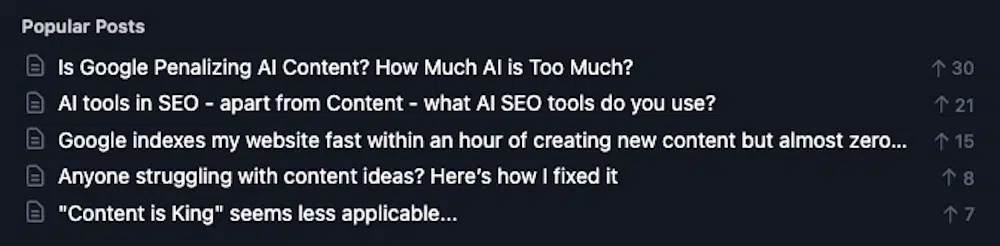

GummySearch lets you create an audience by selecting the most important subreddits to your target users. Then, it automatically tracks what’s trending, including themes, questions and more.

Here’s an example of topics that have been popular among SEOs on Reddit over the past month, based on an audience I created using popular SEO subreddits.

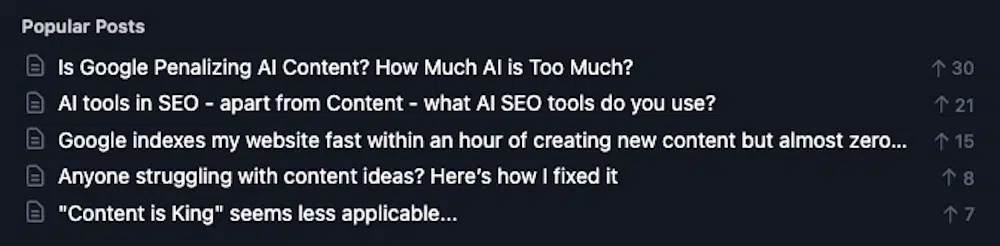

Click on any popular topics – like content – to see the most popular posts. Hello, new content ideas!

Turn Amazon reviews into product use cases

Use cases are crucial for showing people how a product fits into their lives.

But often, brands don’t know every use case for their products – each of which can open up new frontiers of keyword research and content creation.

Products are developed to help users solve problems, so users will always be more intimately familiar with those problems or needs than any brand.

Turning to users of similar products is a great way to discover new needs your offering doesn’t fulfill. Amazon is a great place to do that.

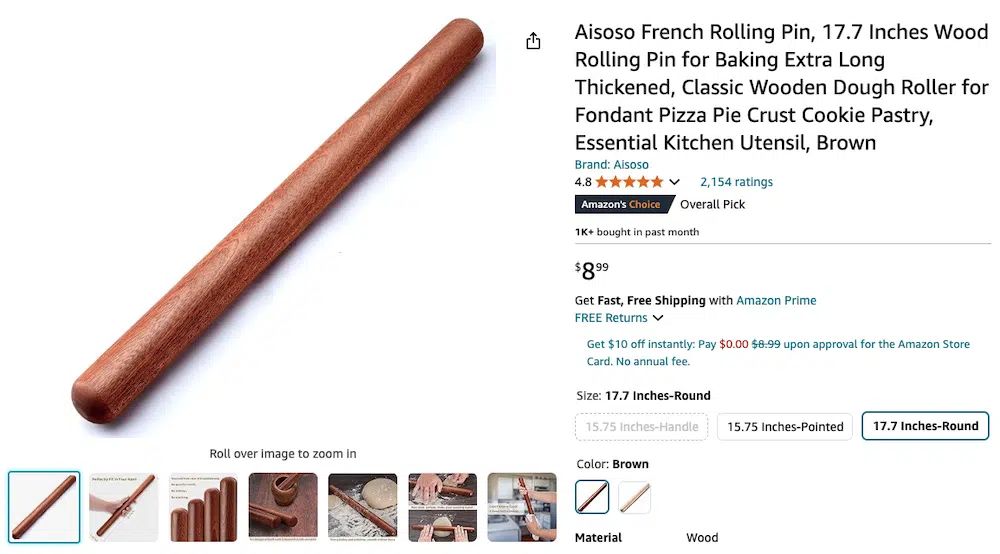

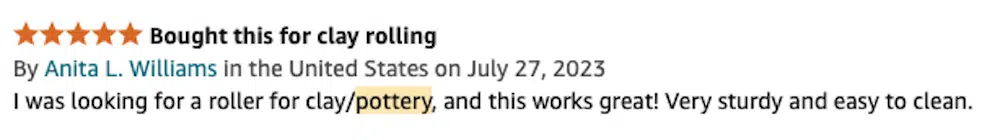

For example, a kitchen supply site likely has a rolling pin in its product catalog. Its marketing might mention using the pin to roll out dough or fondant.

But what about this example user who purchased the rolling pin for their pottery needs? That use case is probably missing from any brand content.

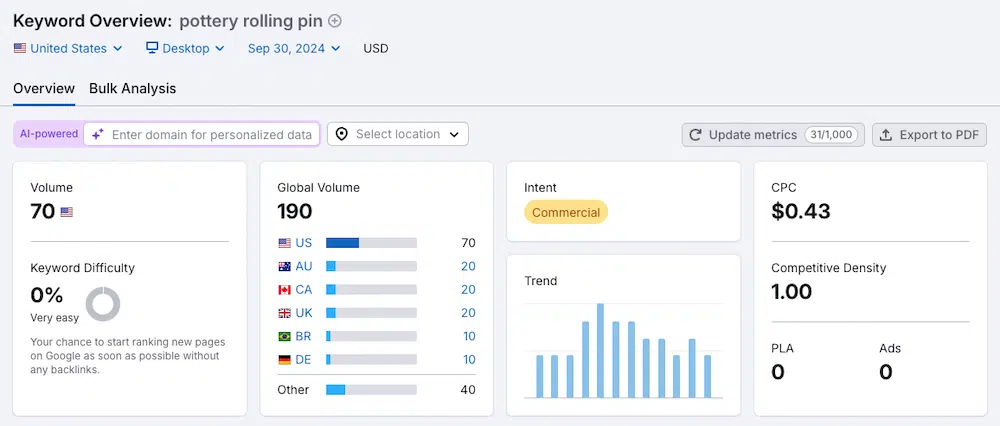

Knowing this information, a brand could better position itself to win traffic from relevant terms like “pottery rolling pin.”

To search for use cases at scale, use a tool like Apify to crawl reviews on relevant Amazon products.

Then, machine learning models can do the heavy lifting of categorizing and quantifying use cases within the reviews! (Hint: Consider doing this with your own reviews, too.)

Use Pinterest to explore trends and demographics

Trends start on social media platforms like Pinterest and TikTok before they make their way to Google.

How is traditional search data going to help highlight what’s trending today? That’s where a source like Pinterest Trends comes in.

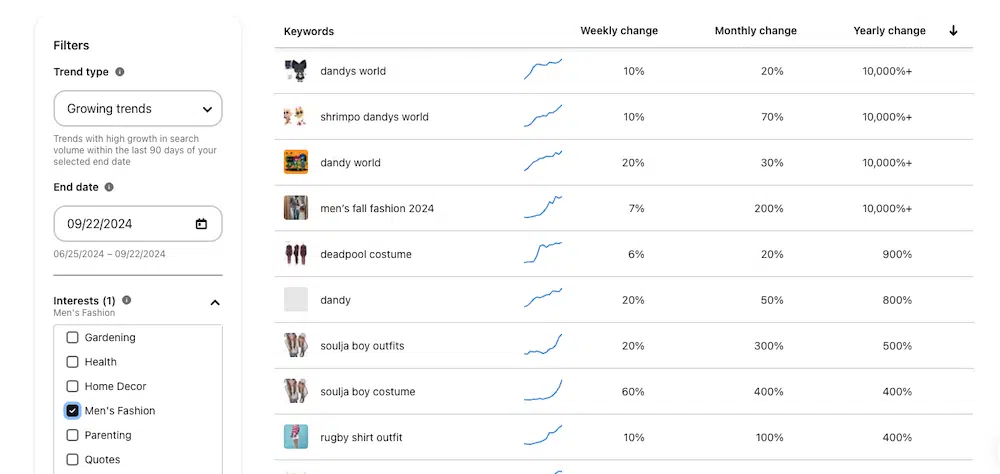

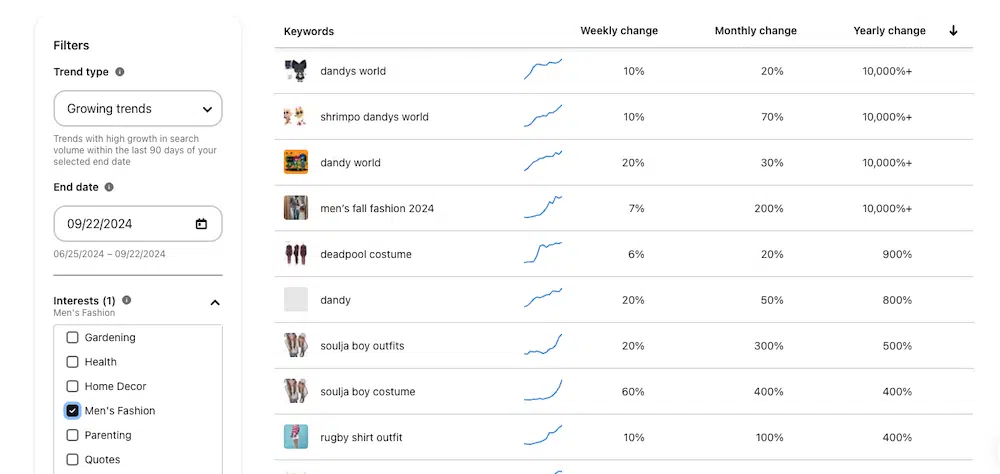

Let’s say I run a lifestyle blog for millennial parents, and Halloween season is approaching. If I’m creating “X Halloween costumes for the family trending this year” content, Pinterest is far more helpful than keyword research.

Just look at all of these trending costume ideas. Sorting the yearly change column gives me a great idea of trends for this year in particular.

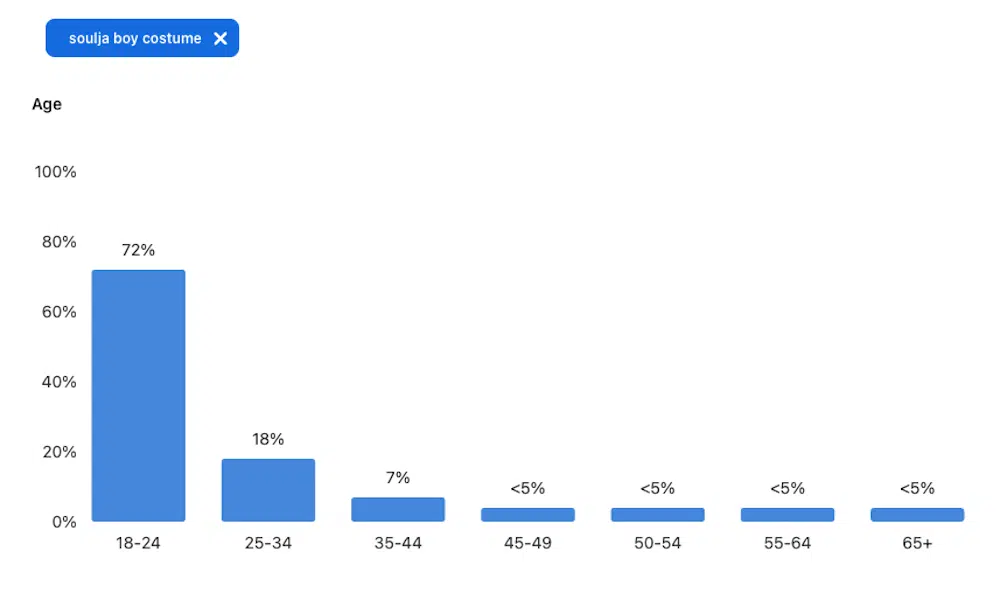

The platform also gives us the demographics for users interacting with certain topics.

If I click on something like “Soulja Boy Costumes,” I can understand whether it’s a good suggestion for my millennial audience. Turns out, probably not.

All of this engagement data is priceless for creating content that reaches my audience with timely, relevant information. It informs user-optimized content rather than just keyword-optimized content, driving SEO performance by giving people a reason to interact and stay on the page.

Which dots will DMI connect for you?

Using social and forum data for SEO content strategy is just the tip of the iceberg.

When we break down data silos with the DMI framework, we open up a whole world of insights beyond just SEO.

As you begin to apply this process to SEO research, pay attention to what the data tells you about the market. What does it mean for other channels or even the business as a whole?

Connecting the dots starts with a fundamental shift in perspective that recognizes the value of the data all around us. That’s what DMI is all about!

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.